2025 Market Crisis? Trump's New Policies Reshape Global Supply Chain, Vietnam Emerging as a New Export Focus?

.jpg)

As 2024 comes to a close, with former U.S. President Donald Trump returning to the White House in 2025, the "America First" policy is expected to trigger a massive reshuffle in the global supply chain once again.

How should your business respond to high tariffs, supply chain restructuring, and soaring costs? How can companies stand firm amidst skyrocketing tariffs, logistics cost hikes, and shrinking market demand?

According to an analysis by Oxford Economics, if China faces high tariffs, global manufacturing output will significantly decline in the short to medium term, with the electronics, automotive, home appliances, and hardware industries taking the first hit. How should business owners prepare for this unprecedented wave of transformation and seize opportunities through strategic planning, regional diversification, and technological upgrades during adversity? Below, we delve into the potential impacts of high tariff policies, industry reshuffling trends, and practical strategies to respond effectively.

The Impact of High Tariffs on the Global Economy: 3 Key Effects of Trump's Policies

With Trump's return, imposing tariffs on imported goods is anticipated to become one of the most closely watched policies.

According to Trump’s campaign manifesto, he plans to impose up to 60% tariffs on Chinese imports, which could rise to 200% if China "enters" Taiwan. This policy is expected to have three major impacts on the global supply chain and manufacturing:

- Significant Increase in Production Costs: High tariffs will directly raise import costs, forcing U.S. domestic companies to pass on these costs to consumers, leading to price hikes and shrinking market demand.

- Supply Chain Risk Concentration: Companies heavily reliant on a single production base will face tremendous risks during tariff policy changes, potentially losing market competitiveness.

- Far-reaching Impact of the USMCA: If Trump suspends the USMCA and imposes 25% tariffs, the North American supply chain will undergo a complete restructuring, affecting millions of jobs.

In this global trade restructuring, Asian manufacturing will play a key role. Regions like Taiwan, Vietnam, and India, with diversified supply chain layouts, are poised to emerge as winners in this transformation..jpg)

Global Supply Chain: Will Vietnam and Taiwan Emerge as the Biggest Winners?

Facing drastic changes in trade policies, many companies have begun relocating production bases to Vietnam, Thailand, and Cambodia. A report by McKinsey Global Institute highlights that relocating production to Southeast Asian countries can reduce supply costs by 10% to 20% compared to China.

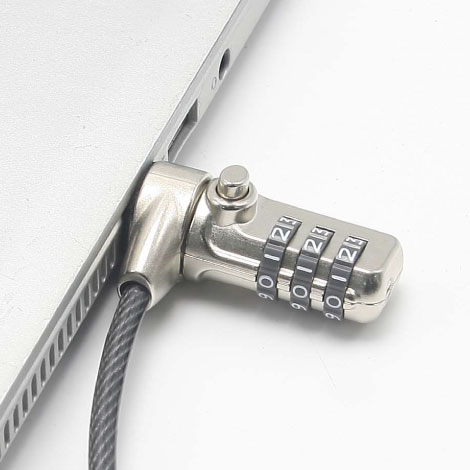

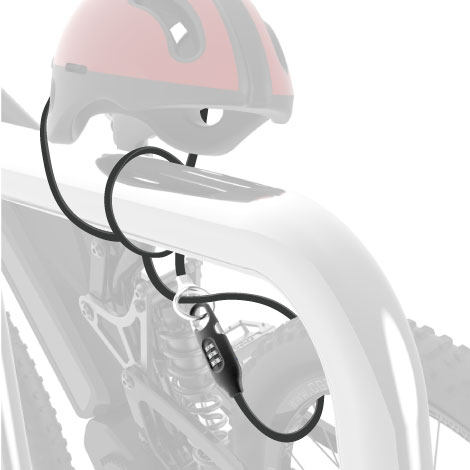

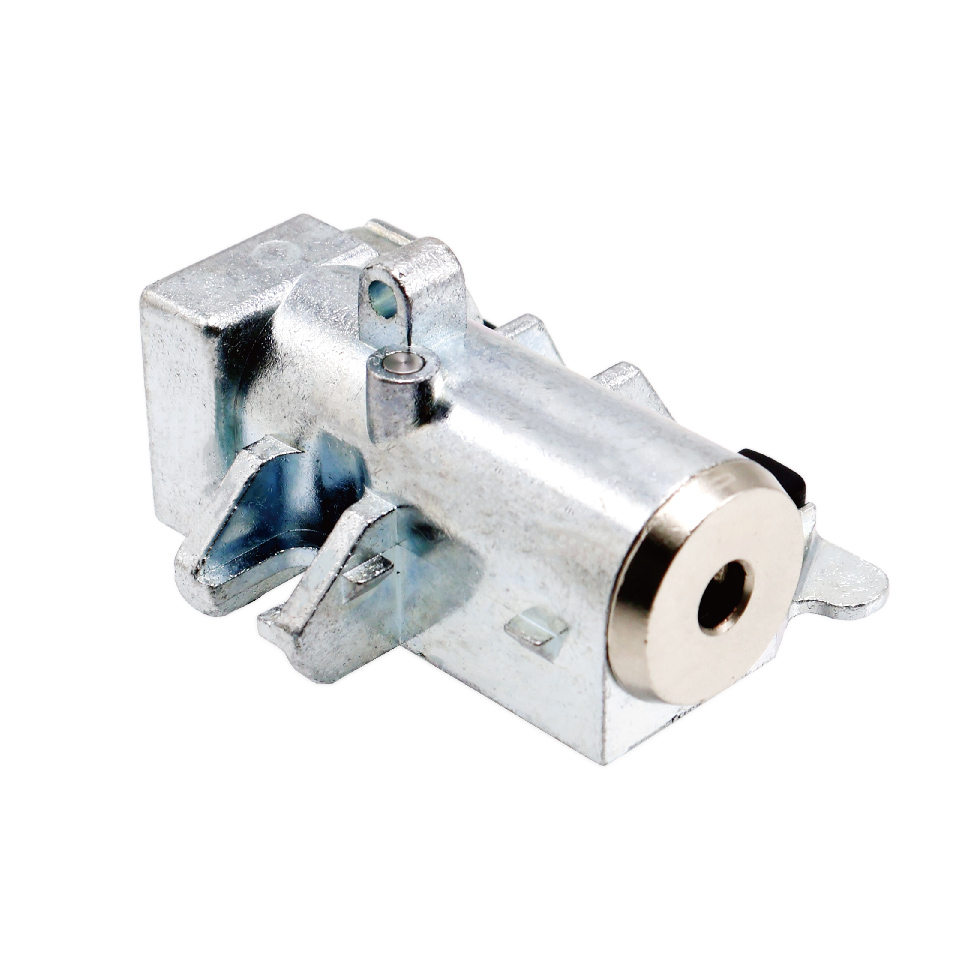

Meanwhile, SINOX, a Taiwanese lock brand, has production facilities in both Vietnam and Taiwan. This cross-regional layout enables it to effectively reduce freight tariff costs and risks when facing U.S. high tariff policies.

- Vietnam Plant: An alternative production base with low tariff costs.

Vietnam’s proximity to China, low labor costs, and well-established logistics infrastructure, coupled with stable trade relations with the U.S., make it a popular production base for businesses post-2025 high tariff policies.

- Taiwan Plant: Competitiveness in customization and R&D manufacturing.

Headquartered in Taiwan, SINOX boasts strong technical R&D and high-quality manufacturing capabilities. Particularly in the lock industry, Taiwan’s precision manufacturing and innovation can deliver high-value-added products to meet the demand for premium products.

By meeting the U.S. market’s dual demands for technology and supply stability, SINOX’s dual-base layout in Vietnam and Taiwan helps businesses diversify risks and enhance competitiveness.

4 Strategies for Companies to Adapt to Supply Chain Restructuring

To respond to drastic changes in trade policies, skyrocketing tariffs, and shrinking market demand, companies must promptly adjust the following four strategies:

- Diversify Supply Chain Layout:

Distribute manufacturing and assembly to Vietnam, Taiwan, India, and other regions to reduce the risks of relying on a single production base. Industries such as automotive, electronics, home appliances, and textiles can adopt regional strategies to avoid political and economic uncertainties.

- Optimize Logistics and Transportation Strategies:

Establish regional distribution centers to shorten supply chain paths, reducing transportation time and costs. Implement digital supply chain platforms (e.g., Amazon Web Services (AWS) Supply Chain) for real-time data analysis and rapid adjustments, minimizing delays caused by policy fluctuations.

- Enhance Product Value:

Invest in technological R&D and innovation to enhance the competitiveness of high-value-added products. Fields like locks, precision machinery, medical equipment, and EV components can leverage technology upgrades and customization to create brand premiums.

- Strengthen Market Strategy Flexibility:

Closely monitor international policy changes, such as WTO and APEC developments, and formulate contingency plans in advance. Flexibly adjust import and export strategies to ensure market share stability.

In the face of the impending global trade reshuffle and high tariff challenges in 2025, industries such as electronics, automotive, hardware components, home appliances, apparel, and medical devices must quickly adapt to a landscape of high tariffs and restricted key component sources. Only by diversifying production bases, expanding to Vietnam, Taiwan, and India, implementing digital supply chain management, and significantly enhancing technological value can businesses stand firm in the new trade order.

Is your business ready to face the upcoming global trade reshuffle and high tariff challenges?

English

English 繁體中文

繁體中文 简体中文

简体中文_11zon.jpg)